NICB Makes Aerial Imagery from Harvey and Irma Available to Public

Before and After Views of Properties Assist Insurers and Emergency Personnel

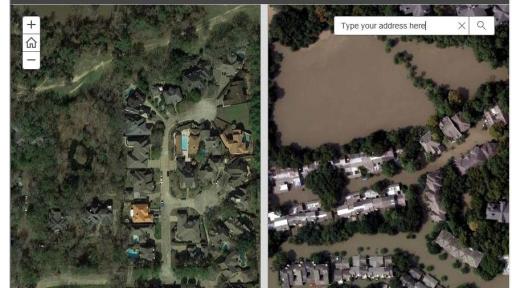

DES PLAINES, Ill—The National Insurance Crime Bureau (NICB) announced today that it will make available to the public high-resolution aerial imagery of areas affected by Hurricanes Harvey and Irma. By going to this link and typing in an address, a before-and-after comparison will be available if the property is in an affected area that has been surveyed from the air. Harvey damage is available and imagery from Irma will be posted when available.

The National Insurance Crime Bureau (NICB), whose member companies write over 80 percent of all property/casualty insurance and over 90 percent of all auto insurance in the country, has been developing a system that leverages its ability to rapidly respond to catastrophes. The system utilizes a full array of digital imagery, both on the ground and in the air, which will provide high-resolution views of properties on an address-by-address level to assess the damage.

NICB and its partners now have the capability to gather before-and-after street level and aerial views of impacted areas, and provide that information in a platform that insurers can incorporate into their existing systems to quickly view and assess damage to their policyholders’ homes, businesses and even vehicles. This same imagery will be provided at no cost to emergency personnel to assist them in their response efforts. The information will also be invaluable in fighting fraud in the aftermath of a disaster.

NICB is working with partners, such as Vexcel Imaging, the premier aerial imaging company worldwide, and Esri, the global provider of GIS mapping and spatial analytics software. NICB has created the Geospatial Intelligence Center to oversee these efforts. Eventually, the plan would be to do imaging on the ground and in the air in some 100 markets on a regular basis, and being able to respond immediately on a 24/7 basis when a catastrophe strikes to provide comparisons that will assist in damage assessment.

“This technology takes the industry response to a catastrophe to a whole new level,” said NICB President and CEO Joe Wehrle. “The response to our initiative has been overwhelmingly positive based on feedback I have received during my meetings with emergency personnel, law enforcement and our insurance company members in Texas. We believe it is also important to share this with those who have been impacted by the Hurricanes.”

NICB’s long history of a strong working relationship with emergency and law enforcement personnel has made this possible. The Texas Department of Public Safety and other local and federal officials have enthusiastically supported this effort, and provided NICB with access and support during the Harvey response.

For an in-depth look at this program, click here to watch our video.

Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800-TEL-NICB (800-835-6422), texting keyword “fraud” to TIP411 (847411) or submitting a form on our website. Or, download the NICB Fraud Tips app on your iPhone or Android device.

About the National Insurance Crime Bureau: Headquartered in Des Plaines, Ill., the NICB is the nation’s leading not-for-profit organization exclusively dedicated to preventing, detecting and defeating insurance fraud and vehicle theft through data analytics, investigations, training, legislative advocacy and public awareness. The NICB is supported by more than 1,100 property and casualty insurance companies and self-insured organizations. NICB member companies wrote over $436 billion in insurance premiums in 2016, or more than 79 percent of the nation’s property/casualty insurance. That includes more than 94 percent ($202 billion) of the nation’s personal auto insurance. To learn more visit www.nicb.org.