Multi-Billion Dollar Medical Fraud Problem Examined in NICB’S ‘THE INFORMER’

Reflections 20 Years After 9/11 Special Feature

Sign Up For Advance Digital NoticeDES PLAINES, Ill., Sept. 7, 2021 — The National Insurance Crime Bureau (NICB), the insurance industry’s association dedicated to predicting, preventing, and prosecuting insurance crime, announces the release of its latest issue of The NICB Informer. In the Fall edition, we take a closer look at medical fraud and its many forms—from inflated billing to fraudulent physicians and staged accident rings.

“The U.S. health care system is a vast network of patients, providers, facilities, insurers, medical products, and related services,” said David Glawe, president and CEO of the National Insurance Crime Bureau. “Because of the system’s massive size and complexity, it is also an attractive target for insurance fraud criminals.”

Crooked physicians, attorneys, and patients commit insurance fraud by submitting false and exaggerated claims. Fraudulent physicians fabricate their credentials, bills, and even their offices without providing treatment. Some unscrupulous providers even pay patients to participate in staged accidents and submit false medical claims to insurers for services never rendered.

NICB’s medical fraud expertise is unparalleled. In-depth articles in this edition range from personal injury protection (PIP) doctors, workers’ compensation and slip and fall since COVID, emerging trends in health care fraud, and crime trends surrounding durable medical equipment.

“The FBI estimates that health care fraud results in tens of billions of dollars in losses each year,” added Glawe. “Unfortunately, we all pay the price for these crimes in the form of higher premiums and out-of-pocket expenses.”

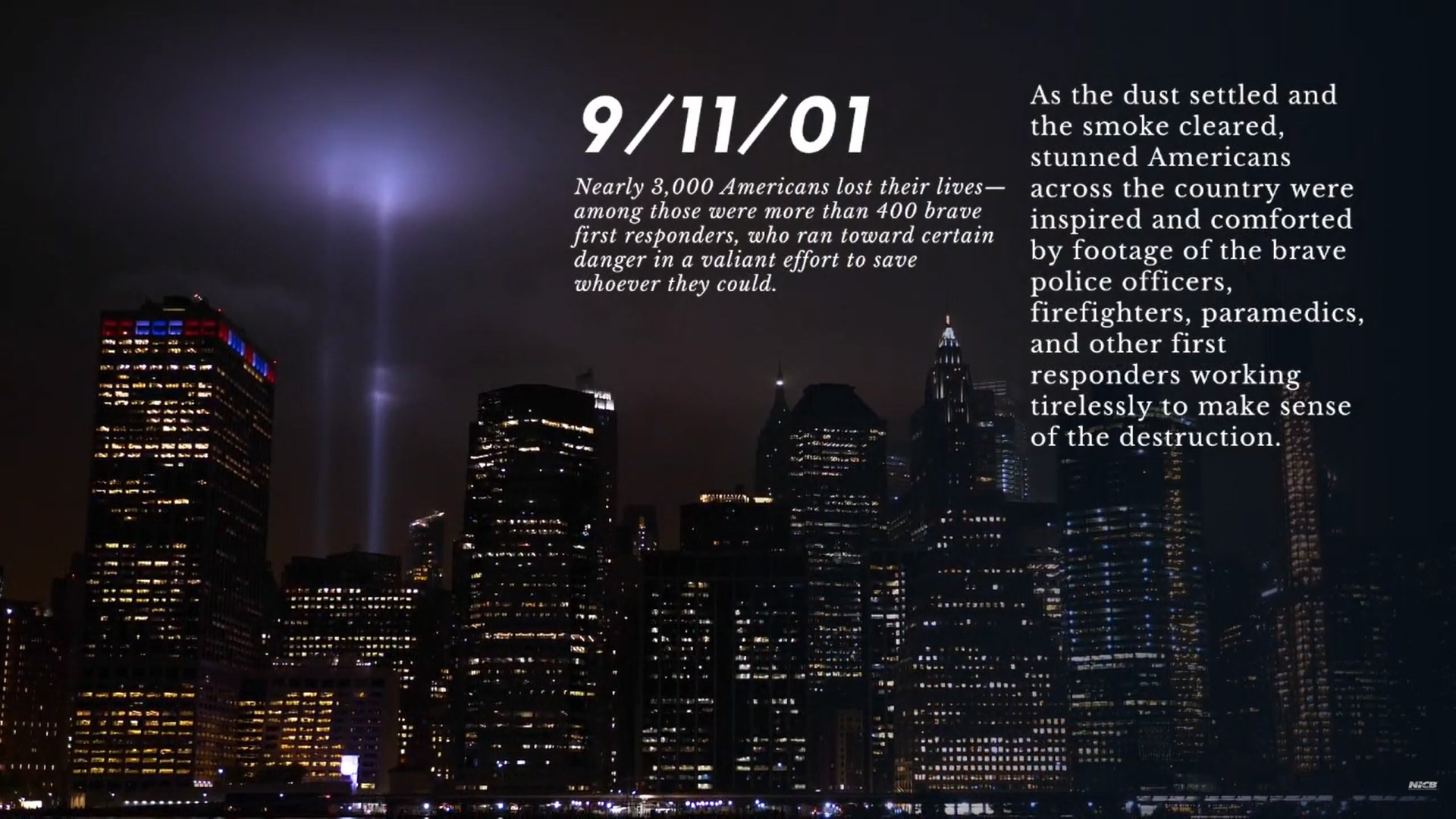

Within this issue, we also remember 9/11. Twenty years ago, nearly 3,000 Americans lost their lives in the September 11 terrorist attacks. NICB agents, who are former law enforcement and first responders, have kindly shared their memories in a special feature in this issue.

“Among those lost were more than 400 brave first responders, who ran toward certain danger in a valiant effort to save whomever they could,” stated Glawe. “NICB acknowledges and thanks the brave firefighters, police officers, and members of our armed services who sacrifice so much to keep our country safe each and every day.”

The NICB Informer is aimed at providing insurance industry executives with anticipatory intelligence to help identify risks and emerging threats to the industry. Anyone interested in receiving digital copy notification can sign up or send an email to [email protected] to be added to the distribution.

REPORT FRAUD: Anyone with information concerning insurance fraud or vehicle theft can report it anonymously by calling toll-free 800.TEL.NICB (800.835.6422) or submitting a form on our website.

ABOUT THE NATIONAL INSURANCE CRIME BUREAU:Headquartered in Des Plaines, Ill., the NICB is the nation's leading not-for-profit organization exclusively dedicated to preventing, detecting, and defeating insurance fraud and vehicle theft through Intelligence & Analytics, and Operations; Education and Crime Prevention; and Strategy, Policy, and Advocacy. The NICB is supported by more than 1,200 property and casualty insurance companies, rental car agencies, auto auctions, and self-insured entities. NICB member companies wrote more than $530 billion in insurance premiums in 2020, or more than 82% of the nation's property-casualty insurance. That includes more than 95% ($236 billion) of the nation's personal auto insurance. To learn more, visit www.nicb.org.

The NICB Informer Fall issue from @insurancecrime is LIVE! Take a closer look at medical #fraud and its many forms—from fraudulent physicians and DME fraud as well as a 9/11 special feature with NICB Agents, who were former NYPD first responders. #September11 #MedicalFraud Tweet

Contacts:

Tully Lehman

925.758.0744

[email protected]

Corey Witte

847.894.2569

[email protected]