Global Study: 64% of Digital Leaders Expect Long-term Changes to Where and How People Work

Equinix report reveals changing working patterns spark surge in digital infrastructure investment

Global Tech Trends Survey Infographic

Global Tech Trends Survey Infographic

REDWOOD CITY, Calif. – May 11, 2021 – Equinix, Inc. (Nasdaq: EQIX), the world's digital infrastructure company™, today announced the findings of its annual global study of the views of IT decision-makers on the biggest technology trends affecting businesses worldwide and the impact of the COVID-19 pandemic on digital infrastructure plans.

Surveying 2,600 IT decision-makers from diverse enterprises across 26 countries in the Americas, Asia-Pacific and EMEA regions, the study reveals:

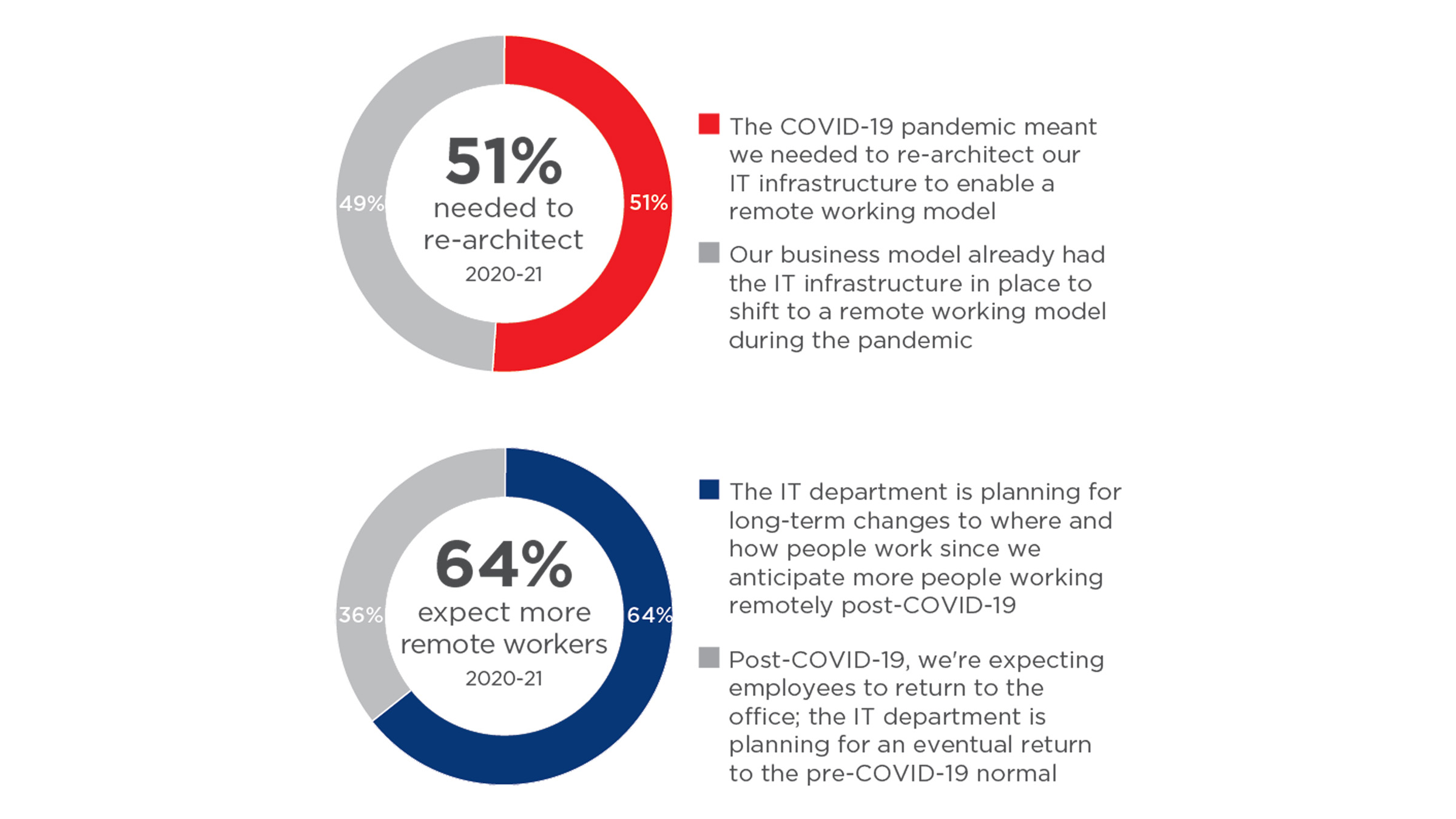

- 51% of global businesses have rearchitected their IT infrastructure to meet new remote and hybrid working demands, with tech budgets increasing to accelerate digital transformation.

- 64% of digital leaders believe there will be long-term changes to where and how people work within their organization.

- More than half (57%) of companies globally still intend to expand into new regions, countries or metros, despite the disruption experienced as a result of COVID-19.

Digital transformation in the post-pandemic future

Digitization and business investment in digital infrastructure have increased as a result of COVID-19. 47% of the digital leaders surveyed around the world said they have accelerated digital transformation plans because of the pandemic, while 42% said their budgets have been increased to satisfy the rapid growth in digital demands.

There has also been a major overhaul of IT strategies to meet the challenges emerging from the pandemic. Six in 10 said they have revised their IT strategy as a result of COVID-19, while 58% said they want to invest in technology to be more agile post-COVID.

Asked about their biggest priorities for their organization’s digital strategy, 80% of respondents reported digitizing their IT infrastructure was a top priority, with 57% saying they see interconnection as a key facilitator of digital transformation—up 9% on last year’s results.

Concerns that the pandemic will have put the brakes on companies’ expansion plans lessened

- 57% of businesses still have plans to expand into new regions, countries or metros, according to the digital leaders surveyed.

- Of that 57%, nearly two-thirds (63%) plan to achieve this virtually, rather than by investing in physical IT infrastructure in-market.

Utilizing interconnection for success

- 58% of IT leaders said they believe interconnection—the direct and private exchange of data between organizations—will help them to navigate the challenges they face due to COVID-19.

- Those stating interconnection was key to their organization’s survival increased to 50%, up from 45% last year.

Claire Macland, Senior Vice President, Global Marketing at Equinix, said: “Digital leaders around the world were clearly already working to accelerate their organizations’ digital transformation. This effort has been supercharged by COVID-19, as this study clearly relays.

“Many companies are now investing more in their digital infrastructure to enable them to embrace a hybrid working model and thrive in the new world of work we all find ourselves in. Despite headwinds in many sectors, many organizations are continuing to expand physically and virtually into new markets and regions around the world.

“This increasing focus on digitization and expansion is one of the reasons why Equinix has continued to invest in its own growth. We completed 16 new expansions in 2020—our most active build year ever—and expect to continue to evolve Platform Equinix to support our customers as they continue on their digital transformation journey.”

The Global Interconnection Index (GXI) Volume 4, a market study recently published by Equinix, forecasts that overall interconnection bandwidth—the measure of private connectivity for the transfer of data between organizations—will achieve a 45% compound annual growth rate (CAGR) from 2019 to 2023, globally. The expected growth is driven by digital transformation, and specifically by greater demands from enterprises extending their digital infrastructure from centralized locations to distributed edge locations.

To read more about the Global Tech Trends Survey, or download a copy, please visit: https://www.equinix.com/resources/infopapers/equinix-tech-trends-survey

Equinix 2020-21 Global Tech Trends Survey, Databook

Equinix 2020-21 Global Tech Trends Survey, Databook

About the Study

The independent study, commissioned by Equinix, surveyed 2,600 IT decision-makers in diverse enterprises across the Americas (Brazil, Canada, Colombia, Mexico, U.S.), Asia-Pacific (Australia, China, Hong Kong, Japan, South Korea, Singapore) and EMEA (Bulgaria, Finland, France, Germany, Ireland, Italy, Netherlands, Poland, Portugal, Spain, Sweden, Switzerland, Turkey, UAE, UK). Respondents were selected for participation from Dynata’s online panel. The survey was conducted online between December 17, 2020 and January 8, 2021.

About Equinix

Equinix (Nasdaq: EQIX) is the world’s digital infrastructure company, enabling digital leaders to harness a trusted platform to bring together and interconnect the foundational infrastructure that powers their success. Equinix enables today’s businesses to access all the right places, partners and possibilities they need to accelerate advantage. With Equinix, they can scale with agility, speed the launch of digital services, deliver world-class experiences and multiply their value.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from expectations discussed in such forward-looking statements. Factors that might cause such differences include, but are not limited to, the challenges of acquiring, operating and constructing IBX data centers and developing, deploying and delivering Equinix products and solutions, unanticipated costs or difficulties relating to the integration of companies we have acquired or will acquire into Equinix; a failure to receive significant revenues from customers in recently built out or acquired data centers; a failure to complete any financing arrangements contemplated from time to time; competition from existing and new competitors; the ability to generate sufficient cash flow or otherwise obtain funds to repay new or outstanding indebtedness; the loss or decline in business from our key customers; risks related to our taxation as a REIT; and other risks described from time to time in Equinix filings with the Securities and Exchange Commission. In particular, see recent Equinix quarterly and annual reports filed with the Securities and Exchange Commission, copies of which are available upon request from Equinix. Equinix does not assume any obligation to update the forward-looking information contained in this press release.

Media contacts

Michelle Lindeman (Americas)

+1 (650) 598-6361

[email protected]

Annie Ho (Asia-Pacific)

+852 2970-7761

[email protected]

Jess Sullivan (EMEA)

+44 7876 712861

[email protected]

Investor Relations

Katrina Rymill

+1 (650) 598-6583

[email protected]

Chip Newcom

+1 (650) 598-6262

[email protected]