Small business employers remain committed to employees through benefits

COLUMBIA, S.C. (May 10, 2021) — A report published by Colonial Life earlier this year shows despite a shaky economy, small business employers have made it a top priority to provide financial protection and health benefits to their employees. The report is based on the findings of a survey conducted by Colonial Life’s parent company, Unum.

“While there remains some uncertainty and financial strain for many small employers, benefits, benefits education and worker attraction and engagement remain major priorities,” said Richard Shaffer, Senior Vice President of Field and Market Development.

main

Video 2

Despite a shaky economy, small businesses are prioritizing their employee well-being with benefits.

Gallery Image

Gallery Image

Photo 2

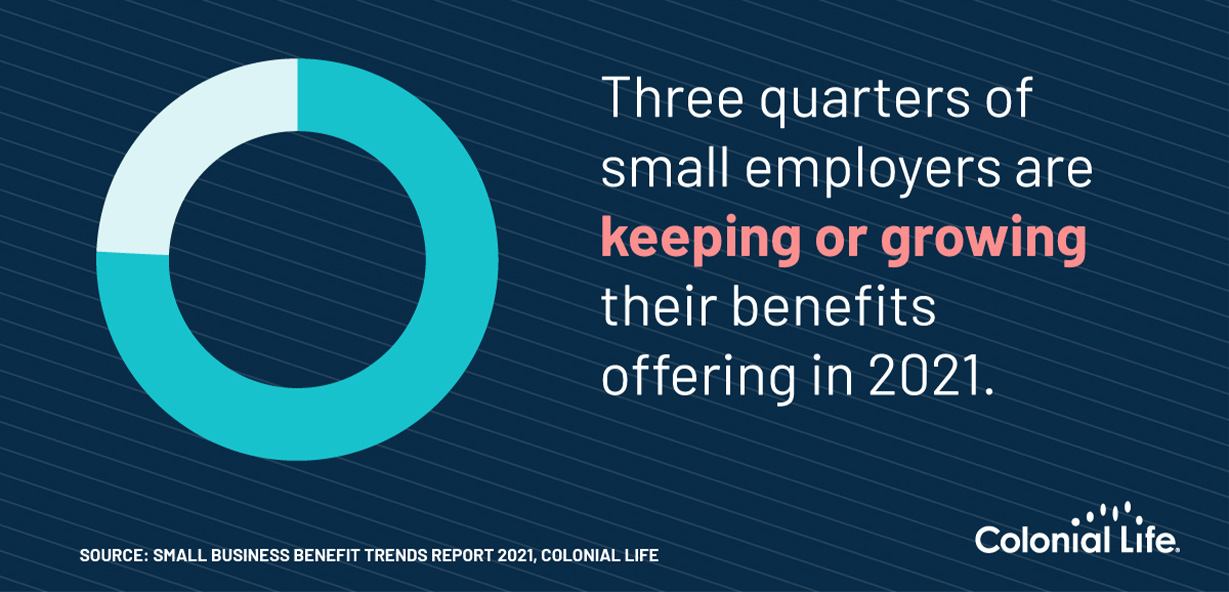

75% of small employers are keeping or growing their benefits offering in 2021.

Despite a shaky economy, Colonial Life finds small business employers prioritize financial protection and benefits for their employees. Learn more here. Tweet

The Small Business Benefits Trend report also found:

- 36% of small businesses are planning to hire new employees.

- 76% of small business will keep their benefits packages intact or add more benefits in 2021.

- 20% of small businesses plan to increase the employer portion of premiums paid.

And employees agree – the need for these benefits and the financial protection they provide have never been more important. According to a 2020 Workplace Wellness Survey conducted by the Employee Benefit Research Institute (EBRI) and Greenwald & Associates:

- Seven in ten (70%) employees agreed that they need their employer’s help ensuring they are healthy and financially secure, and just over six in ten (60%) say it is their employer’s responsibility to do so.

- To a great and growing degree, employees said employer-offered benefits contribute to their feelings of financial security.

Yet, the financial health of a business will invariably affect its ability to offer benefits. And while federal funding provided some relief, 75% of the small employers surveyed said their overall financial health significantly or somewhat impacted the benefits they planned to offer this year.

This data point, coupled with employees’ elevated interest and need for financial protection options, has led to the steadily increasing interest in leveraging voluntary benefits as a solution.

Voluntary benefits offer a customizable solution for the specific needs of businesses and their employees. They can provide flexibility to employees – catering to certain stages of life and lifestyles.

These benefits can also provide flexibility to employers by offering various funding options like 100% employee-paid or employer-employee shared funding.

Contact your local benefits representative to learn more about offering voluntary benefits to your employees.

*Unum, parent company to Colonial Life, Employer Survey, 2020. 321 U.S. employers with 250 or fewer employees responded to the survey from November 30 – December 11, 2020.

ABOUT COLONIAL LIFE

Colonial Life & Accident Insurance Company is a market leader in providing financial protection benefits through the workplace, including disability, life, accident, dental, cancer, critical illness and hospital confinement indemnity insurance. The company’s benefit services and education, innovative enrollment technology and personal service support more than 90,000 businesses and organizations, representing more than 3.8 million of America’s workers and their families. For more information visit www.coloniallife.com or connect with us on Facebook, Twitter and LinkedIn.