ORLANDO, Fla. – March 18, 2021 – PureCycle Technologies, Inc. (NASDAQ: PCT) announced that it has completed its previously announced business combination with Roth CH Acquisition I Co. (NASDAQ: ROCH) (“Roth CH”). The business combination was approved by Roth CH’s stockholders at a special meeting held on March 16, 2021. Upon completion of the business combination, the combined company changed its name to PureCycle Technologies, Inc., (dba “PureCycle”) and its common stock, is expected to begin trading on the Nasdaq Stock Market under the ticker symbol “PCT” commencing March 18, 2021. The Company’s units and warrants will trade under the symbols “PCTTU” and “PCTTW,” respectively.

“The consummation of this transaction represents yet another major milestone for PureCycle, demonstrating broad market validation of our value proposition,” said PureCycle Chairman and CEO Mike Otworth. “Most importantly, we now have the increased capital market access to support the accelerated scaling required to revolutionize the transformation of waste polypropylene into sustainable products.”

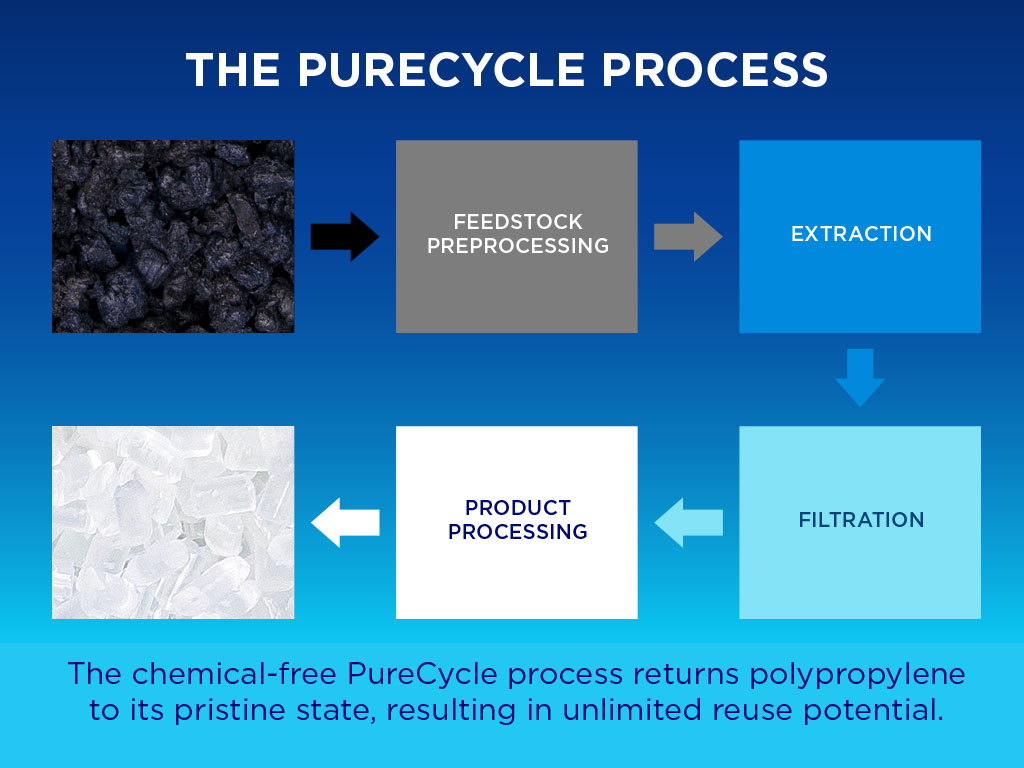

Purecycle, an Innventure company, uses proprietary technology licensed from Procter & Gamble to recycle waste polypropylene (PP) into virgin-like recycled PP for myriad applications. The company is the intersection of an enabling technology meeting a compelling global need: only approximately 1% of the 170 billion pounds of polypropylene consumed last year was recycled as compared to almost 20% for polyethylene terephthalate (PET), according to the American Chemistry Council.

The plastic revolution starts now—with PureCycle’s groundbreaking process that turns waste polypropylene into pure, clean resin. @PureCycleTech is remaking a difference #GlobalRecyclingDay. Tweet

Gallery Image

Gallery Image

PureCycle offers the only patented recycling process for polypropylene that separates color, odor and other contaminants from plastic waste, transforming it into recycled polypropylene with virgin-like properties.

Gallery Image

Gallery Image

Our process fully closes the loop in the reuse of recycled plastics. PureCycle makes ultra-pure recycled polypropylene accessible at scale to companies desiring to use a sustainable, recycled resin.

Gallery Image

Gallery Image

“The consummation of this transaction represents yet another major milestone for PureCycle, demonstrating broad market validation of our value proposition,” said PureCycle Chairman and CEO Mike Otworth. “We now have the increased capital market access to support the accelerated scaling required to revolutionize the transformation of waste polypropylene into sustainable products.”

“What if we could make plastic once—and then reuse it over and over again? That’s PureCycle’s vision,” said Mike Otworth, PureCycle chairman and CEO.

Gallery Image

Gallery Image

PureCycle is the first company to focus solely on recycling and purifying polypropylene, which is used in food and beverage packaging, consumer goods packaging, automobiles, electronics, home furnishings and a myriad of other applications.

“We are incredibly excited to complete our business combination with PureCycle,” said Byron Roth, chairman and CEO of Roth CH. “PureCycle’s revolutionary and proprietary technology to recycle waste polypropylene into virgin-like resin is not only transformative, but also beneficial to our planet. We are confident that PureCycle has the resources to deliver substantial value for all stakeholders.”

Perella Weinberg Partners and Oppenheimer & Co. Inc. acted as financial advisors to PureCycle. Jones Day acted as legal advisor to PureCycle and Loeb & Loeb acted as legal advisor to Roth CH.

Transaction Overview

The business combination will enable PureCycle to build additional capacity beyond its Ironton, Ohio facility to deliver desired volumes to PureCycle’s customers.

“Over the last three months, PureCycle has further developed its financial and manufacturing capabilities,” Otworth continued. “This is now an execution game for PureCycle. It’s incumbent on us to pull forward the best, most knowledgeable leaders to ensure that we realize the full potential of this technology. In addition to the rapid expansion of our world-class executive team, I am quite pleased with the addition of Fernando Musa, Tim Glockner and Jeffrey Fieler to our board to further enhance our growth, bringing additional finance and manufacturing expertise.”

Michael Dee, PureCycle’s chief financial officer, noted that over the last year PureCycle has raised over $730 million in a variety of sources and from an “extraordinary group of highly sophisticated investors” who share the PureCycle vision, in a variety of financial transactions. This capital will be mostly dedicated to PureCycle’s expansion and corporate development in the coming year and provides a solid financial footing for the future of this revolution in the ability to recycle polypropylene.

Senior Management

PureCycle will continue to be led by Michael Otworth as chief executive officer and chairman of the board. The senior management team includes Michael Dee, chief financial officer, David Brenner, chief commercial officer, Dustin Olson, chief manufacturing officer, Brad Kalter, general counsel and corporate secretary, and Tamsin Ettefagh, chief sustainability officer.

The strength of the PureCycle team continues to expand with the recent strategic hires of Missy Westerman, corporate controller, Gene Guerra, vice president of financial planning and analysis, Brett Hafer, vice president of manufacturing operations, Jim Haw, vice president of automation and digital strategy, Dan Holloway, vice president of human resources and Mike Weber, vice president of technology.

Board of Directors

PureCycle has further strengthened the composition of the board by bringing in industry leaders in finance (Tanya Burnell and Jeffrey Fieler) and operations (Fernando Musa and Tim Glockner). The PureCycle board is composed of seven members, including Mike Otworth, John Scott, Rick Brenner, Tanya Burnell, Tim Glockner, Fernando Musa and Jeffrey Fieler.

About PureCycle Technologies

PureCycle Technologies LLC, dba PureCycle, holds a global license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company (P&G), for restoring waste polypropylene (PP) into virgin-like resin. The proprietary process removes color, odor and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market. To learn more, visit purecycletech.com.

About Roth CH Acquisition I Co.

Roth CH Acquisition I Co. is a blank check company incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. Roth CH is jointly managed by Roth Capital Partners and Craig-Hallum Capital Group. Its initial public offering occurred on May 4, 2020 raising approximately $76.5 million. For more information, visit rothch.com.

Forward-Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements about the anticipated benefits of the business combination and the prospects of Roth CH and/or PCT and include statements for the period following the consummation of the business combination. When used in this press release, the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of Roth CH and PCT, as applicable, and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in the public filings made or to be made with the SEC by Roth CH, including in the final prospectus relating to Roth CH’s IPO, which was filed with the SEC on May 6 2020 under the heading “Risk Factors,” the proxy statement and prospectus relating to the business combination, which was filed with the SEC on February 12, 2021 under the heading “Risk Factors,” or made or to be made by the newly created publicly-listed holding company, to be renamed PureCycle Technologies, Inc. upon closing of the transaction, and the following: PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s recycled polypropylene in food grade applications; PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the recycled polypropylene and PCT’s facilities; expectations regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; PCT’s ability to scale and build the Ironton plant in a timely and cost-effective manner; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; PCT’s future capital requirements and sources and uses of cash; PCT’s ability to obtain funding for its operations and future growth; developments and projections relating to PCT’s competitors and industry; the outcome of any legal proceedings that may be instituted against Roth CH or PCT following announcement of the merger agreement and the transactions contemplated therein; the risk that the consummation of the business combination disrupts PCT’s current plans; the ability to recognize the anticipated benefits of the business combination; unexpected costs related to the business combination; the amount of any redemptions by existing holders of Roth CH’s common stock being greater than expected; limited liquidity and trading of Roth CH’s securities; geopolitical risk and changes in applicable laws or regulations; the possibility that Roth CH and/or PCT may be adversely affected by other economic, business, and/or competitive factors; operational risk and the risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on Roth CH’s or PCT’s business operations, as well as Roth CH’s or PCT’s financial condition and results of operations. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Roth CH and PCT prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Neither Roth CH nor PCT undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Media Contact

Laura Mansfield, APR

Tombras

[email protected]

865.599.9968

PureCycle Contact

Amy Jo Clark

[email protected]

317.504.0133

Investor Relations Contacts

Cody Slach, Tom Colton

Gateway Investor Relations

[email protected]

(949) 574-3860