EXPLORING THE FACTS BEHIND THE ONGOING HOUSING AFFORDABILITY CRISIS

Learn How Rising Building Materials Prices are Dramatically Impacting Home Buyers

For More InformationBACKGROUND:

An unexpectedly quick rise in interest rates, rising home prices and rents, and escalating lumber and material costs have significantly decreased housing affordability conditions, particularly for entry-level buyers and renters.

Historically high price levels for lumber and other building materials are dramatically affecting home prices and rental costs plus threatening the nation’s economic stability. Year-over-year, the prices for building materials increased 19.2% and have risen 35.6% since the start of the pandemic. Production has also not kept pace with demand and home inventories are lean with the U.S. housing market being short more than 1 million single-family homes of what is needed to meet the country’s demand.

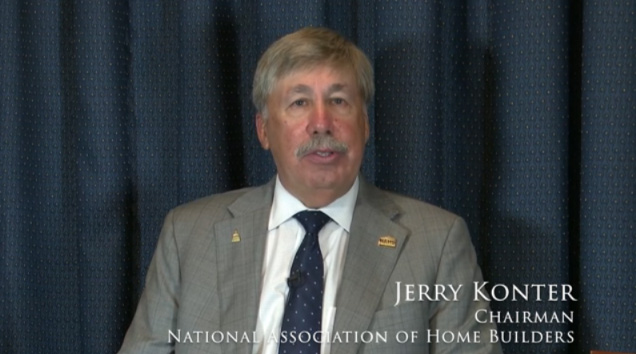

National Association of Home Builders (NAHB) Chairman Jerry Konter shares how supply chain price increases have added to the ongoing housing affordability crisis. This is a direct result of supply chain bottlenecks that have caused many builders to delay or cancel projects because they don’t have access to lumber or other building materials at a reasonable price. Housing can do its part to create jobs and lead the economy forward, but in order to do so, the skyrocketing lumber and building material prices need to be addressed as well as the chronic production bottlenecks.

DID YOU KNOW (as of May 17, 2022)?

- Home building material costs are up 19.2% year-over-year and 35.6% since the start of the pandemic. These historically high costs continue to imperil the U.S. housing sector and are dramatically affecting home prices and rental costs.

- The price spike in the lumber package alone since last August has added more than $18,600 to the price of a typical new single-family home and approximately $10,000 to the cost of a typical apartment.

- Freddie Mac reported rates increased to 5.27% - they were 3.11% at start of the year and are at the highest rate since Aug. 2009. This is the biggest percent change on record of data going back to 1972.

- For-sale and rental housing affordability has been declining since the Great Recession due to underbuilding and now stands at more than a 10-year low. NAHB estimates a net deficit of U.S. housing totaling more than 1 million homes.

For more information visit: www.nahb.org/supplychain

MORE ABOUT JERRY KONTER:

Jerry Konter, a Savannah, Ga.-based builder with over 40 years of experience in residential construction, is NAHB’s 2022 Chairman of the Board. He is founder and president of Konter Quality Homes, which builds a range of designs in production home communities and is also a custom builder. The company has built more than 2,200 single-family and 700 multifamily homes.

Produced for: National Association of Home Builders